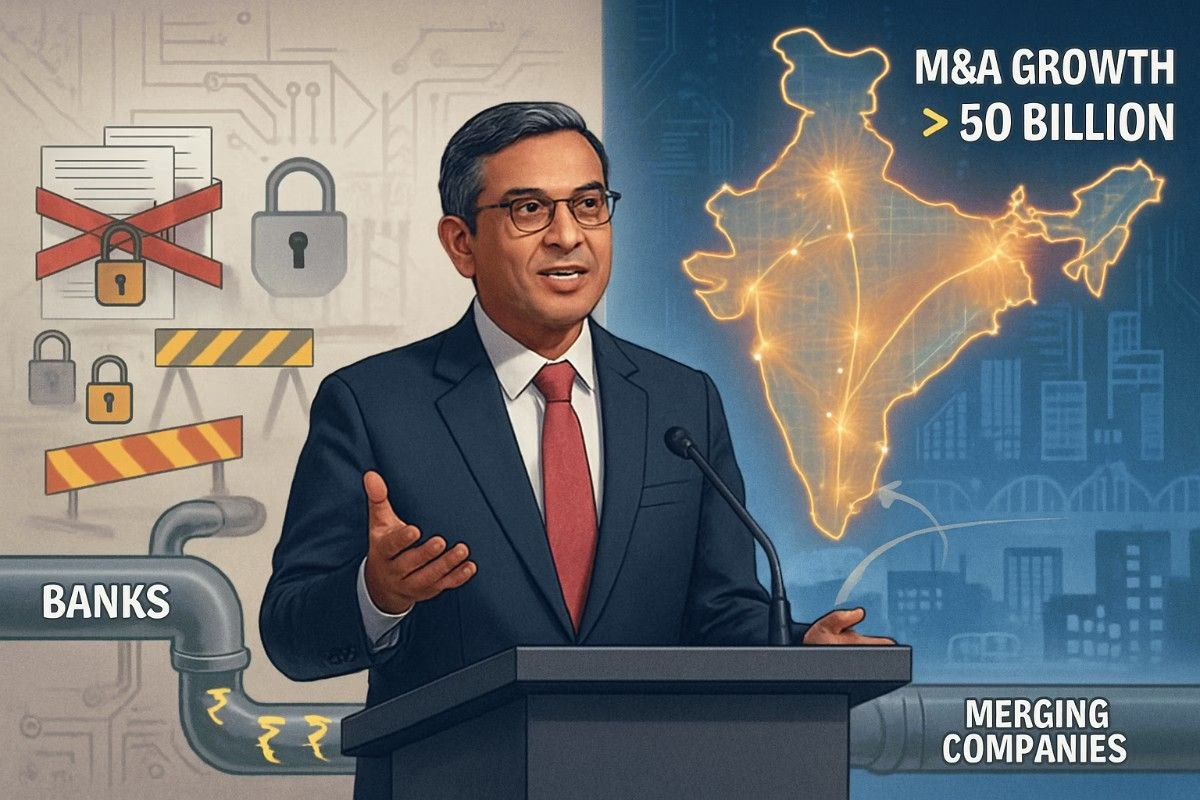

Mumbai, August 26, 2025 — State Bank of India (SBI) Chairman C.S. Setty has urged policymakers and regulators to revisit the existing framework governing bank participation in corporate mergers and acquisitions (M&A), stressing that India needs a more enabling financial environment to fully unlock its growth potential.

Speaking at a high-profile industry forum on corporate finance and investment, Setty pointed out that the Indian economy has entered a phase of rapid consolidation, with both domestic and global deal-making at historic highs. According to data presented at the event, M&A volumes in India crossed $50 billion in the first half of 2025, making it one of the most active half-years in recent memory.

However, despite this impressive momentum, Setty warned that India could be “leaving opportunities on the table” because of restrictive rules that limit how much banks can contribute to acquisition financing. Currently, many corporates depend heavily on alternative sources such as private equity, global funds, and structured debt instruments to finance acquisitions—avenues that are often more complex and costlier than traditional bank lending.

“Indian corporations are increasingly seeking consolidation and strategic acquisitions to scale, diversify, and compete globally. If our banking system is not equipped to support them at this crucial stage, we risk slowing down the pace of transformation. To truly compete with global markets, our regulatory framework must evolve in line with international best practices,” Setty said.

Why This Matters

Experts believe India’s M&A market is on the cusp of a structural shift. Sectors such as technology, infrastructure, renewable energy, pharmaceuticals, and financial services are driving the consolidation wave. Startups and mid-sized firms, too, are looking at mergers and buyouts as a way to expand rapidly and survive in an increasingly competitive market.

Private equity and venture capital firms continue to pour billions into Indian companies, but analysts argue that for sustainable long-term growth, domestic banks must play a larger role in providing acquisition financing.

Industry watchers note that if India aligns its banking rules with those of developed markets, it could open the floodgates for larger, more complex deals, while also ensuring that Indian corporates don’t lose ground to global competitors.

The Regulatory Gap

At present, the Reserve Bank of India (RBI) imposes restrictions on banks when it comes to financing acquisitions, mainly due to concerns around risk exposure and asset quality. While this prudence has helped shield the financial system from excessive risk, many industry veterans now argue that the time is right to revisit these rules.

Setty emphasized that a balanced approach—one that protects banks from over-leverage while allowing greater participation in well-structured deals—would be crucial. He added that providing banks with more flexibility in acquisition funding would not only fuel corporate growth but also deepen India’s capital markets.

Analysts’ Take

Market analysts welcomed Setty’s call for reform, saying it reflects the growing recognition that India’s financial architecture must adapt to its ambitions of becoming a global investment and business hub. “The country has the talent, the companies, and the capital inflows. What it needs is a supportive regulatory structure that enables smoother and faster transactions,” said an M&A consultant at a leading global advisory firm.

The Road Ahead

With M&A activity already at record highs and more sectors likely to consolidate in the coming years, the SBI Chairman’s appeal adds urgency to the reform debate. If regulators take steps to ease the financing bottleneck, India could see not just higher deal volumes but also larger cross-border acquisitions, cementing its place as a global powerhouse in deal-making.

As India continues its journey toward becoming a $5 trillion economy, experts agree that the time is ripe to strengthen its M&A ecosystem—one where banks, regulators, and corporates work together to drive sustainable and competitive growth.