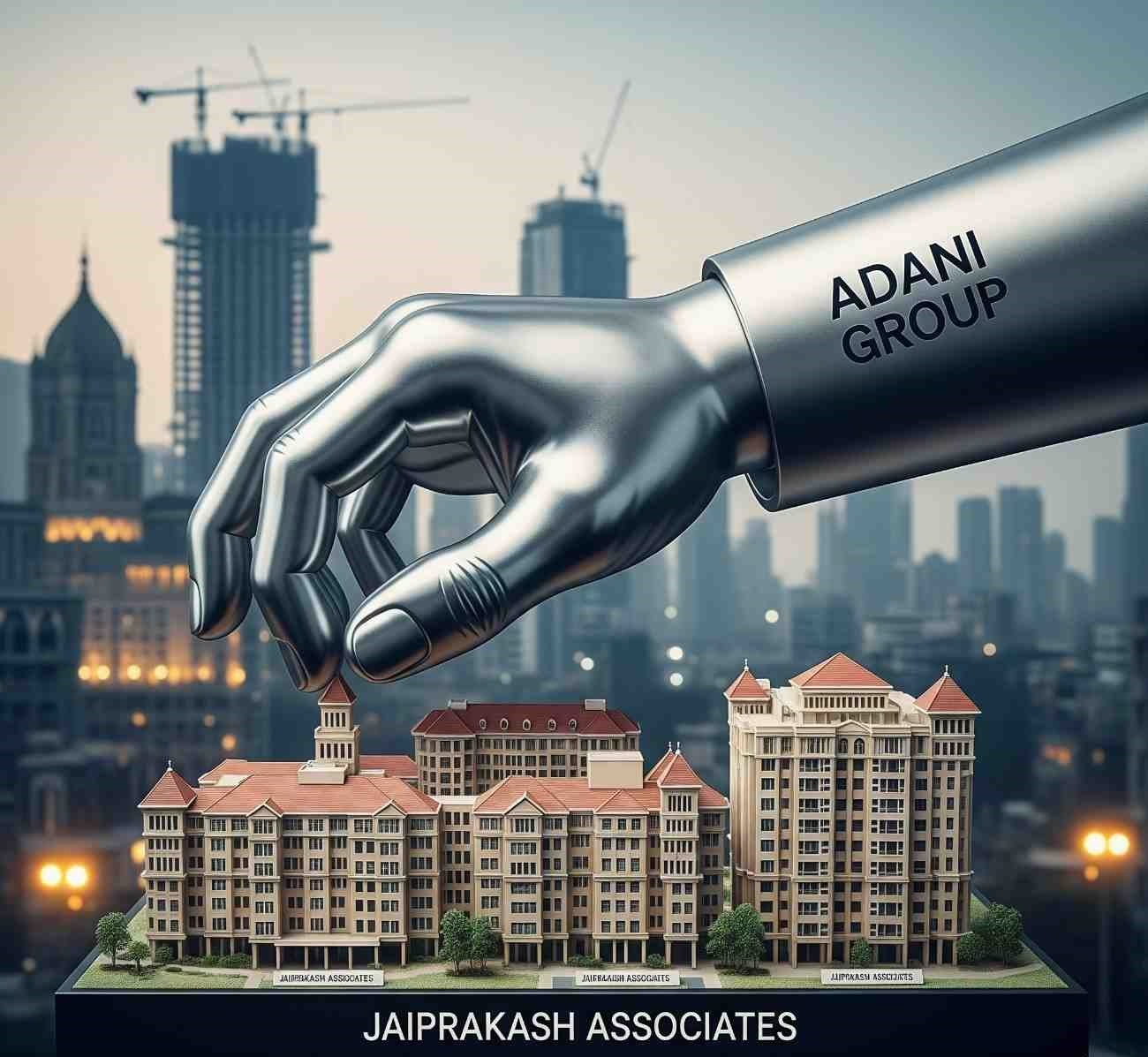

In a landmark development in India’s corporate and infrastructure landscape, the Competition Commission of India (CCI) has granted approval to the Adani Group for its proposal to acquire up to 100% shareholding in Jaiprakash Associates. This acquisition marks a pivotal move for the Adani conglomerate, positioning it as a stronger leader in construction, energy, and infrastructure development across India. The deal demonstrates the group’s aggressive expansion strategy and highlights its intent to consolidate key assets in sectors critical to India’s economic growth.

Strategic Significance of the Acquisition

Jaiprakash Associates, with its diversified portfolio in cement, construction, and energy projects, offers a wide array of assets that are strategically aligned with Adani Group’s long-term objectives. The acquisition provides Adani access to high-value projects and critical infrastructure assets that complement its existing portfolio, including renewable energy initiatives, logistics networks, and large-scale urban development projects.

Analysts point out that this move strengthens Adani’s presence in the infrastructure domain, allowing the group to leverage operational synergies and enhance efficiency across construction and power generation projects. By integrating Jaiprakash Associates’ resources, Adani can streamline supply chains, reduce operational costs, and increase market competitiveness.

The acquisition also aligns with India’s broader national infrastructure agenda, supporting initiatives in renewable energy, smart cities, highways, and urban development projects. By expanding its footprint in these critical areas, Adani Group is positioning itself as a preferred partner for both government and private sector infrastructure projects.

Regulatory Clearance and Compliance

The CCI’s approval represents the final regulatory milestone required for the acquisition. The Commission conducted a thorough review of the proposed transaction, ensuring that it does not create unfair market concentration or hinder competition within the sectors concerned.

The approval is a strong signal of confidence in the legality and compliance of Adani’s acquisition strategy. Corporate governance experts highlight that regulatory clearance from the CCI is crucial for large-scale mergers and acquisitions in India, as it reassures investors, stakeholders, and financial institutions about the transaction’s legitimacy.

With the regulatory hurdle cleared, Adani can now proceed to integrate Jaiprakash Associates’ operations fully, optimizing resources and deploying capital more efficiently to achieve strategic growth objectives.

Financial and Operational Implications

While the exact financial details of the deal have not been disclosed, industry experts estimate that the acquisition represents a multi-thousand-crore investment by Adani. This deal is expected to significantly increase the conglomerate’s asset base, revenue streams, and operational capacity.

Integrating Jaiprakash Associates’ cement plants, energy projects, and construction portfolios is projected to generate substantial operational synergies, including:

- Cost Efficiency: Streamlining operations and procurement to reduce overall operational costs.

- Enhanced Market Share: Increasing Adani’s dominance in construction and energy sectors.

- Revenue Growth: Tapping into high-value projects and leveraging economies of scale.

In addition, this acquisition complements Adani’s renewable energy and infrastructure ambitions, particularly in solar and wind projects. By acquiring Jaiprakash Associates’ assets, Adani can accelerate ongoing projects and explore new investment opportunities across India’s rapidly growing infrastructure landscape.

Market Reaction and Implications

The announcement of the CCI approval has generated significant interest among investors, market analysts, and industry stakeholders. Analysts note that the acquisition reinforces Adani’s image as one of India’s most dynamic and growth-oriented conglomerates.

The stock market reaction reflects investor optimism, with expectations that the acquisition will enhance Adani’s valuation, strengthen earnings potential, and consolidate its position as a leader in infrastructure development.

Furthermore, the acquisition could influence sector-wide trends, as other major corporations may explore strategic mergers and acquisitions to remain competitive in a rapidly evolving infrastructure and construction market.

Strategic Outlook and Future Plans

Looking forward, the integration of Jaiprakash Associates’ operations is expected to open multiple growth avenues for Adani Group:

- Infrastructure Expansion: Accelerating development in highways, ports, urban housing, and renewable energy projects.

- Operational Synergies: Leveraging complementary resources and expertise to enhance efficiency and reduce costs.

- Sustainability Initiatives: Strengthening Adani’s renewable energy portfolio to align with India’s sustainability targets.

- Financial Growth: Enhancing revenue streams and profitability through expanded project execution and market share.

Industry observers suggest that this acquisition positions Adani Group as a dominant player capable of shaping India’s infrastructure landscape in the coming decade. The strategic integration of Jaiprakash Associates’ assets not only strengthens Adani’s market position but also demonstrates the conglomerate’s commitment to long-term growth and national development.

Conclusion

The CCI’s approval of the Adani-Jaiprakash Associates acquisition represents a landmark moment for India’s corporate and infrastructure sectors. By strategically consolidating high-value assets, Adani Group is poised to enhance operational efficiency, expand its project portfolio, and lead the country’s infrastructure development initiatives.

As India continues to witness large-scale investments in energy, construction, and urban development, this acquisition exemplifies the role of strategic corporate expansion in driving national growth. Adani’s bold move signals confidence in the future, setting a precedent for other corporations seeking to leverage mergers and acquisitions as a tool for sustainable growth and industry leadership.